SACRAMENTO, CALIFORNIA / ACCESS Newswire / January 30, 2025 / River City Bank reported its 9th consecutive year of record net income with $73.4 million or $49.90 per diluted share for the year ended December 31, 2024; this was $13.1 million more than the $60.3 million or $40.49 per diluted share for the year ended December 31, 2023. The Bank also reported net income of $21.3 million, or $14.52 per diluted share, for the quarter ended December 31, 2024, which compares favorably to the $16.8 million, or $11.28 per diluted share, for the same period in 2023. The Bank's earnings for the year ended December 31, 2024 represented a healthy 16.3% return on equity capital and 1.42% return on assets. The Bank's book value per share rose to $336 as of December 31, 2024 from $287 per share as of December 31, 2023.

The improved net income versus the prior year was driven by the following factors:

Higher loan balances - Average loan outstandings in 2024 were $515 million higher than the prior year and yields on loans increased by 0.39% (including the impact of the fair value hedges), driving the increase in loan interest income.

Deposit growth - Average deposits grew by $734 million compared to the prior year, supporting growth in the Bank's loans and liquid assets.

Increased investment securities balances and yields - Average investment securities and cash balances grew by $210 million while yields increased from 3.45% in 2023 to 4.76% in 2024.

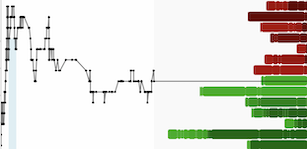

Stable net interest margin (NIM) - Despite higher deposits costs in 2024, NIM decreased by only 0.08% to 2.66% in 2024 from 2.74% in the prior year. The stable NIM, supported by the Bank's hedging program, combined with the significant loan growth, allowed the Bank to grow net interest income by $15.8 million in 2024.

The provision for credit losses was $7.5 million in 2024, which was $5.1 million less than the $12.6 million provision expense in 2023. The Bank did not experience any credit losses during the year and the Bank's Allowance for Credit Losses for Loans was 2.39% of Gross Loans as of December 31, 2024.

"The 2024 results and continued growth of the Bank to over $5.1 billion in total assets as of December 31, 2024, demonstrates the appreciation our customers have for the over 50 years of consistently exceptional service the Bank continues to deliver," said Steve Fleming, president and chief executive officer. "Our loan quality remains pristine with virtually no delinquencies or non-performing loans. We believe we can continue to grow our commercial real estate loan portfolio focusing on loans secured by multi-family, retail, and industrial properties in the western United States, as well as growing loans and deposits with our commercial and agribusiness clients. We will remain diligent with our monitoring of potential impacts to the office segment of our commercial real estate loan portfolio from the reduction in demand as employers continue to provide work-from-home opportunities for their employees. The Bank's balance sheet remains liquid with $149 million in cash and $701 million in high-quality short duration investments (investment portfolio effective duration of only one year)."

"Operational efficiency remains a core competency for the Bank, as evidenced by our 27 percent efficiency ratio for the year ended December 31, 2024." said Brian Killeen, chief financial officer of River City Bank. "The Bank's high quality investment securities portfolio continues to perform well with relatively small unrealized losses of less than 1.5% and there are no investment securities categorized as held-to-maturity."

Shareholders' equity for River City Bank for the year ended December 31, 2024, increased $67 million to $485 million, when compared to the $418 million as of December 31, 2023. The increase was driven by current year retained earnings. The Bank's capital ratios remain well above the regulatory definition for being Well Capitalized, with a Tier 1 Leverage Ratio of 9.1% as of December 31, 2024.

Additionally, Mr. Fleming announced that the Bank's board of directors has approved a cash dividend of $0.40 per common share (increased from $0.37) to shareholders of record as of February 12, 2025, and payable on February 26, 2025.

ABOUT RIVER CITY BANK:

Named one of Sacramento Business Journal's "50 Fastest Growing Companies" for each of the past seven years, River City Bank is a leading boutique commercial bank throughout California with assets of over $5.1 billion. River City Bank offers a comprehensive suite of banking services, including loans, deposits and cash management tools to businesses, consumers, municipalities, and commercial real estate sectors. With a tailored, concierge-like level of service, River City Bank redefines the banking experience and every touch point that surrounds it. River City Bank is the largest, independent, locally owned and managed bank in the Sacramento region with an office in the San Francisco Bay Area and a presence in Southern California. With an expertise in clean energy, River City Bank is committed to driving sustainable growth and empowering the communities it serves. For additional information, please visit www.rivercitybank.com or call (916) 567-2600. Member FDIC. Equal Housing Lender.

Contact Information

Pamela Hansen

VP/Director of Marketing and Events

pamela.hansen@rivercitybank.com

7075484292

SOURCE: River City Bank

View the original press release on ACCESS Newswire